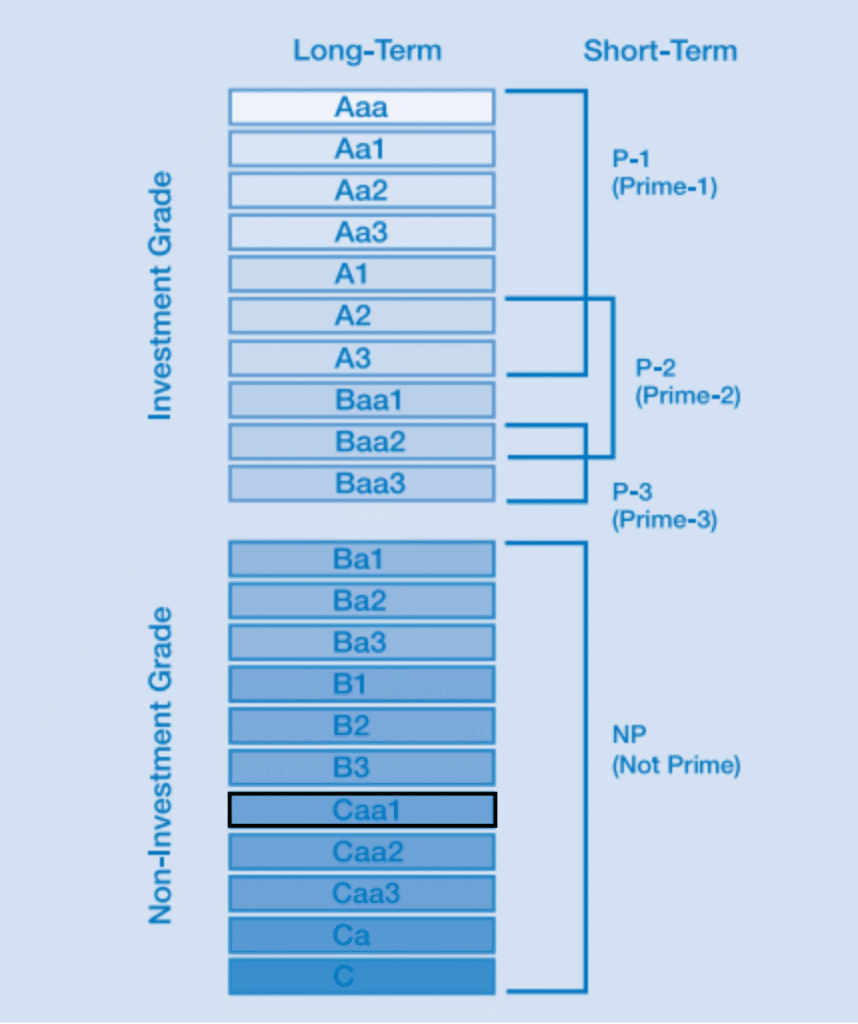

In a significant boost to investor confidence, Moody’s Ratings has upgraded Pakistan’s credit rating scale from Caa2 to Caa1 with a stable outlook, lifting the country out of immediate default danger. The move follows consistent improvements in Pakistan’s external and fiscal position, largely driven by progress under the International Monetary Fund (IMF) programme and a series of economic reforms.

This is the first upgrade in a year by the global credit rating agency, placing Pakistan alongside countries like Sri Lanka, Egypt, and Tunisia in the speculative-grade category. However, Moody’s has cautioned that despite the upgrade, Pakistan’s foreign exchange reserves remain fragile and debt affordability is still among the weakest globally.

According to Moody’s, the upgrade reflects Pakistan’s improving external position, supported by:

- Steady reform implementation under the IMF’s Extended Fund Facility.

- Higher foreign exchange reserves, which rose to $14.3 billion by July 25, 2025 — equivalent to 10 weeks of imports.

- Stronger revenue collection, with tax-to-GDP ratio increasing from 12.6% to 16% last fiscal year.

- Fiscal deficit narrowing to 5.4% of GDP in FY2025, with a further decline to 4.5–5% expected in FY2026.

The agency also acknowledged the government’s tough measures, including tax reforms, reduced subsidies in the power sector, and controlled expenditure despite an increase in defence spending.

While acknowledging Pakistan’s improved debt repayment capacity, Moody’s warned that the country still faces external financing needs of $24–25 billion annually for FY2026 and FY2027 — totaling about $50 billion over two years.

Moody’s expects Pakistan to fully meet its external debt obligations over the next few years if reforms continue and IMF reviews are completed on time. However, delays in reform execution could jeopardize official financing and weaken the external position again.

Interest payments are projected to drop significantly from 60% of revenues in FY2024 to 40–45% in the coming years due to lower domestic interest rates. Still, Moody’s noted that these payments remain high by international standards.

Exclusive: Moody’s Ratings Upgrades Pakistan Sovereign Ratings, Completing the Triple Upgrade after Fitch and S&P

— Khurram Schehzad (@kschehzad) August 13, 2025

– Moody's Ratings upgraded Pakistan’s local and foreign currency credit ratings to Caa1 from Caa2, citing improving external buffers, fiscal consolidation, and…

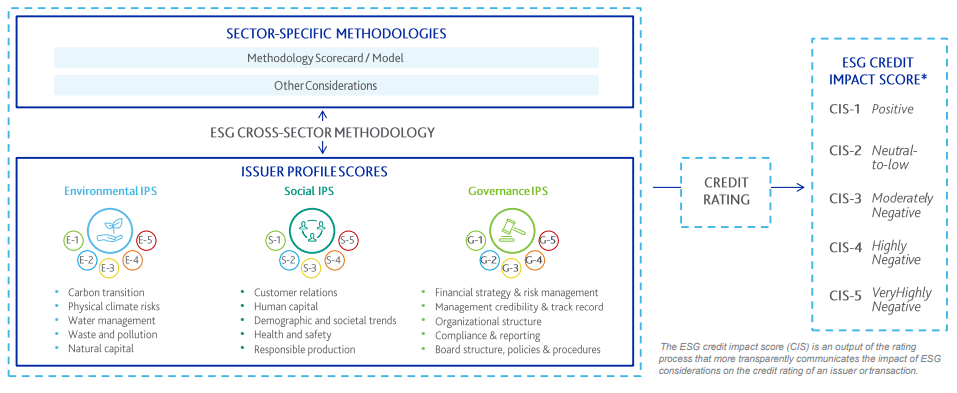

The agency also flagged weak governance, political uncertainty, and social risks as constraints on Pakistan’s credit profile. Moody’s assigned Pakistan an ESG Credit Impact Score of CIS-5, reflecting high vulnerability to climate change, income inequality, and governance challenges.

Prime Minister Shehbaz Sharif welcomed the upgrade, calling it proof that Pakistan’s economic policies are on the right track. He praised his economic team for stabilizing the economy after the country narrowly avoided default less than two years ago.

Finance Ministry officials also highlighted that all three top global rating agencies — Moody’s, Fitch, and S&P Global Ratings — have now upgraded Pakistan’s outlook to stable in 2025, boosting prospects for investor confidence and potential access to global capital markets.

While the rating upgrade is a positive milestone for Pakistan’s economy, the journey ahead remains challenging. Sustained reforms, improved revenue mobilization, careful debt management, and political stability will be critical for maintaining momentum.

Moody’s emphasized that building a track record of reform implementation could unlock additional financing from bilateral and multilateral partners — ultimately strengthening Pakistan’s economic resilience.