The U.S. Bureau of Labor Statistics (BLS) will release July’s Consumer Price Index (CPI report) today at 8:30 a.m. ET, and market players are bracing for what could be the most consequential inflation print of the summer. With traders pricing in an 80.6% probability of a 25 basis point Federal Reserve rate cut in September, the stakes couldn’t be higher.

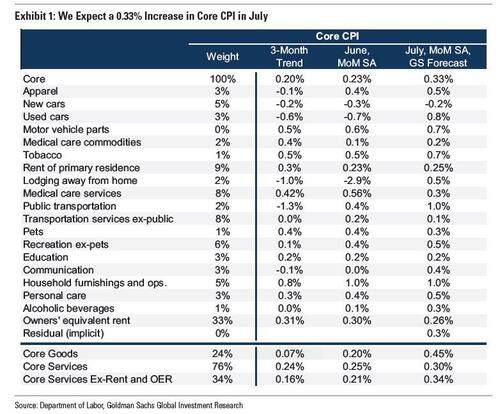

According to economists surveyed by Reuters, headline CPI is expected to rise 0.2% month-over-month (down from 0.3% in June), pushing the annual rate to 2.8% from 2.7%. Core CPI — excluding food and energy — is forecast to climb 0.3% MoM and 3.0% YoY, marking its largest gain in six months.

Key drivers include:

- Tariff-sensitive goods such as furniture, apparel, and electronics showing notable price increases.

- Used cars potentially up 0.75%, while new cars may decline 0.2% due to dealership incentives.

- Airfares projected to jump 2%, despite seasonal softening.

Goldman Sachs estimates that roughly half of the expected core inflation in the coming months could be tariff-related, with the other half reflecting the final stages of residual inflationary pressures.

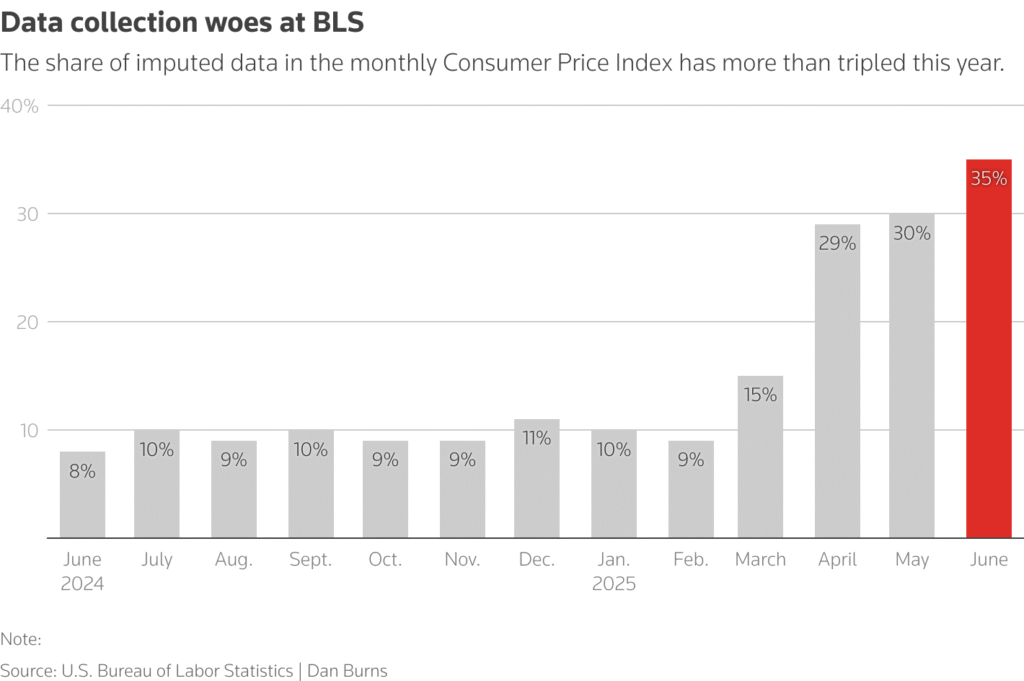

The CPI release comes amid growing doubts over data quality. Following budget cuts and staffing shortages, the BLS has suspended data collection in some U.S. cities and reduced coverage by 15% in others. This has forced the agency to impute — or estimate — up to 35% of CPI components in June, a sharp rise from just 8% a year ago.

Economists warn this reliance on estimates could increase volatility and investor skepticism, especially after President Donald Trump’s removal of BLS chief Erika McEntarfer earlier this month.

The Federal Reserve faces a delicate decision:

- Doves argue that cooling labor markets — with unemployment steady at 4.2% — justify a preemptive rate cut to support growth.

- Hawks caution that inflation remains above the 2% target, urging restraint.

Fed officials like Neel Kashkari and Mary Daly have hinted strongly at a September cut, with Kashkari suggesting it’s better to cut now and reverse later than to risk waiting too long.

Wall Street is positioned for calm, with the VIX at 15.8 — its lowest since December — and S&P 500 options pricing a 0.70% move post-release. However, a “hot” core CPI reading above 0.4% could spark sharp selloffs across equities, bonds, and the U.S. dollar.

JPMorgan’s scenario guide:

- Core > 0.40%: SPX down 2%–2.75%

- 0.35%–0.40%: –0.75% to +0.25%

- 0.30%–0.35%: Flat to +0.75%

- Below 0.25%: Rally of +1.5% to +2%

Unless inflation comes in significantly hotter than expected, a September Fed rate cut remains likely. The bigger question: Will the cut be framed as insurance in a stable economy — or as the start of a longer easing cycle driven by deeper growth fears?

For traders, today’s CPI is more than just an inflation report — it’s the gatekeeper to the next major monetary policy shift.